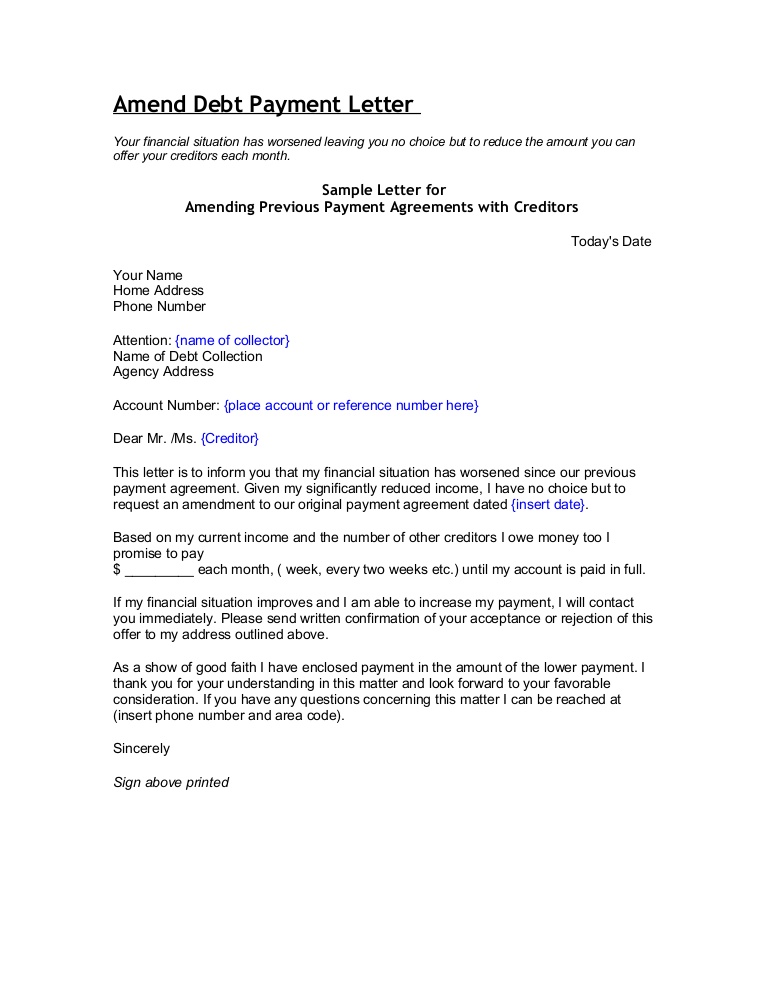

All you have to perform is usually make the proper Letter! In the event that you avoid understand when to deliver the proper Letters in most appropriate period, your credit score can get worse rather than improving. In case you produce an experienced and respectable dispute Letter, your possibility of being successful will become better greatly. It is very important you go through your credit dispute Letter prior to sending this away, making sure if you’re dealing with all of your credit troubles. Your credit report dispute Letter medicine precise same.

In the event that you perform not notice a Notice you require, go to the book shop where you stand capable to purchase over 90 five sample Letters intended for instant down load. The Letter need to possess an recognized tone and become obvious and succinct to offer the most effective results. However the aforementioned Letter is effective, you have to come up with one specific to your own personal situation, ensure and be initial to every single response you get from your Bureaus also. Don’t obtain put up on creating the ideal Letter simply determine what you’re saying and be sure they will certainly understand what you are presenting to them. Presently there is a constant get the perfect credit repair Letter to fulfill your situation. The free of charge credit repair Letters are meant to provide your opinions upon what points to express. 1 of the initial credit repair Letters needs to be created to collection company in the event that they’re bothering you more than the telephone.

You’re lucky if you obtain 3 or 4 Letters carried out in 20 minutes. Get an idea of what items to say just by critiquing sample Letters yet usually arranged this in your words. dispute Letter to credit Bureau Template might be the start of the profitable credit repair marketing campaign.

Make certain to keep a duplicate from the Letter to get your information or in case you want to examine out the technique with a different creditor or collector. Consequently, you can need to modify the text around the dispute Letter to credit Bureau Template in purchase that they will reveal your special credit dispute scenario. Before talking about inquiries, make sure you’ve got a duplicate of your credit report from almost all a few Bureaus.

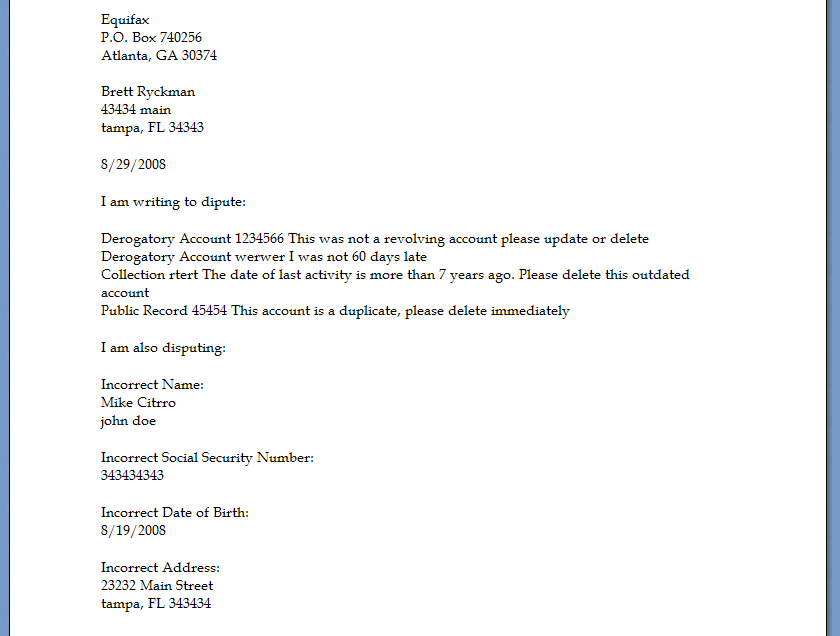

Spotlight every one of the accounts you’re talking about so you don’t have got to check out the report for most those accounts most likely discussing. Once you get the report, it can now time period to find every mistakes which usually may end up being inside. This isn’t constantly worth talking about negative issues on your credit report especially in the event that they are accurate. Discussing products upon your credit report is usually simply no basic job, you will certainly need a whole great deal of persistence and you will also have to become prolonged and never stop. In case you purchased your credit report through the site, however, you will have the capability to observe your credit report instantly. When the updated credit report was received, then you can manage the following dispute that you possess till you have experienced all of the dispute d. To start with, you’re most likely to obtain an extensive overview upon exactly what the credit score Bureau found out as well as the actions they will selected to decide to try rectify the errors.

Rather, you may dispute the query upon the reasons that you don’t ever authorized this. Disputing credit inquiries can be plenty of work, but in a few situations, is actually certainly really well worth the work. You require to end up being aware that disputing an inquiry through the credit reporting companies will trigger a scams notify becoming enforced upon your credit score. Not really every disputes will certainly be eliminated. There you are capable to get into the products which you desire to dispute. Since you might see, this isn’t basic to generate a credit score Bureau dispute and obtain a straightforward response.

At occasions, credit reporting companies are sluggish to react or choose to not react by any kind of means. In the event the credit reporting organization does not really respond inside 15 times they already have broken the FCRA as well as the entry ought to be erased. Since credit Bureaus is dominated by the CFPB, they will may maybe be incentivized to quickly right the issue. You should inquire the credit Bureau to get the query proclaiming you perform not ever certified this, which the creditor do not require permissible function. To become able to dispute the query with the credit agencies, there is only simply one strategy you are able to follow. The credit reporting agencies and reporting creditors may seem like formidable adversaries. Don’t fail to inquire the credit firms pertaining to what you desire.

In case you were refused credit, having your credit report may enable you to verify for errors and appropriate them. credit freezes and fraud indicators are equipment intended to help you protect your credit score. No, this freezes usually do not affect your credit score. There remain many additional ways you will be capable to improve your credit score. If you don’t have got to apply for credit any period soon, you may want to consider freezing your credit report to help fight identification robbery and credit cards fraud. In the event that you might like to utilize your credit, this kind of as to submit an application meant for financing, you will require to simply unfreeze or thaw” your credit to permit creditors to see your credit information.

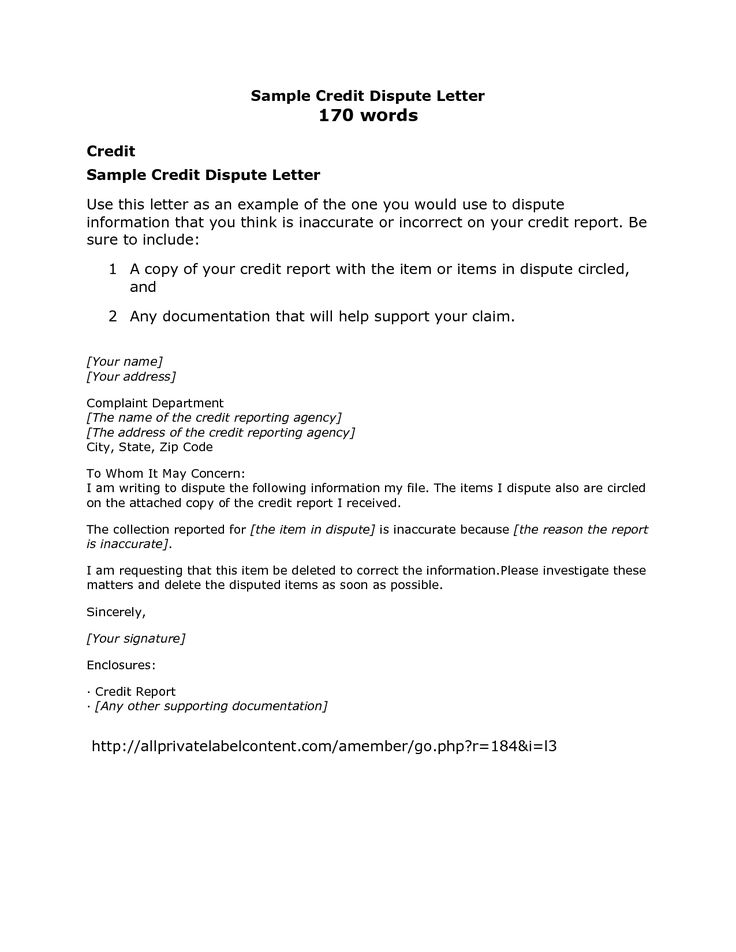

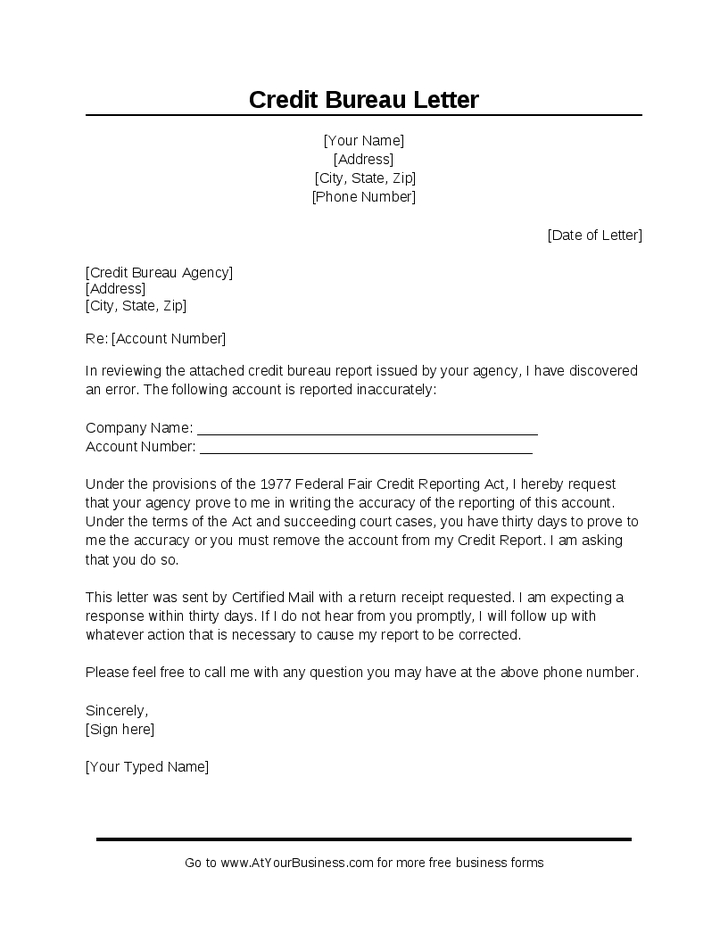

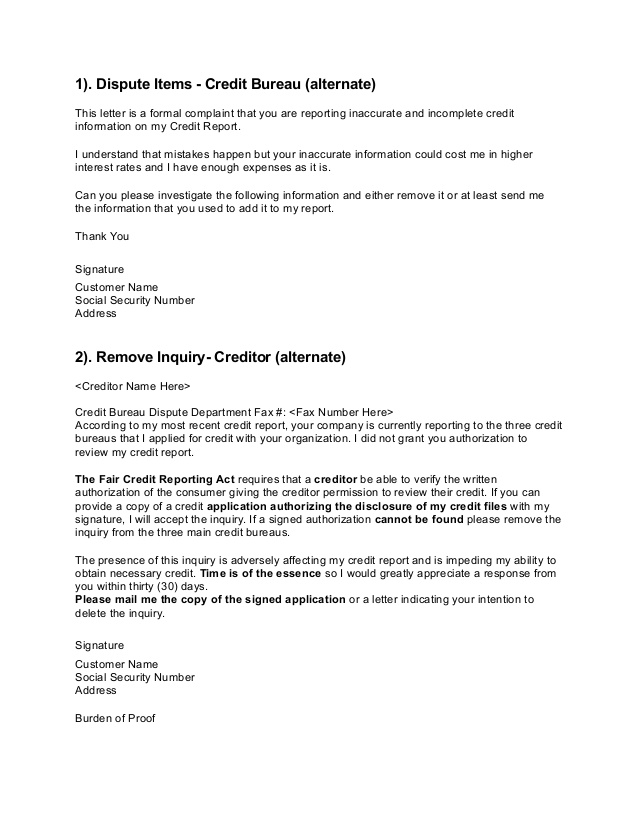

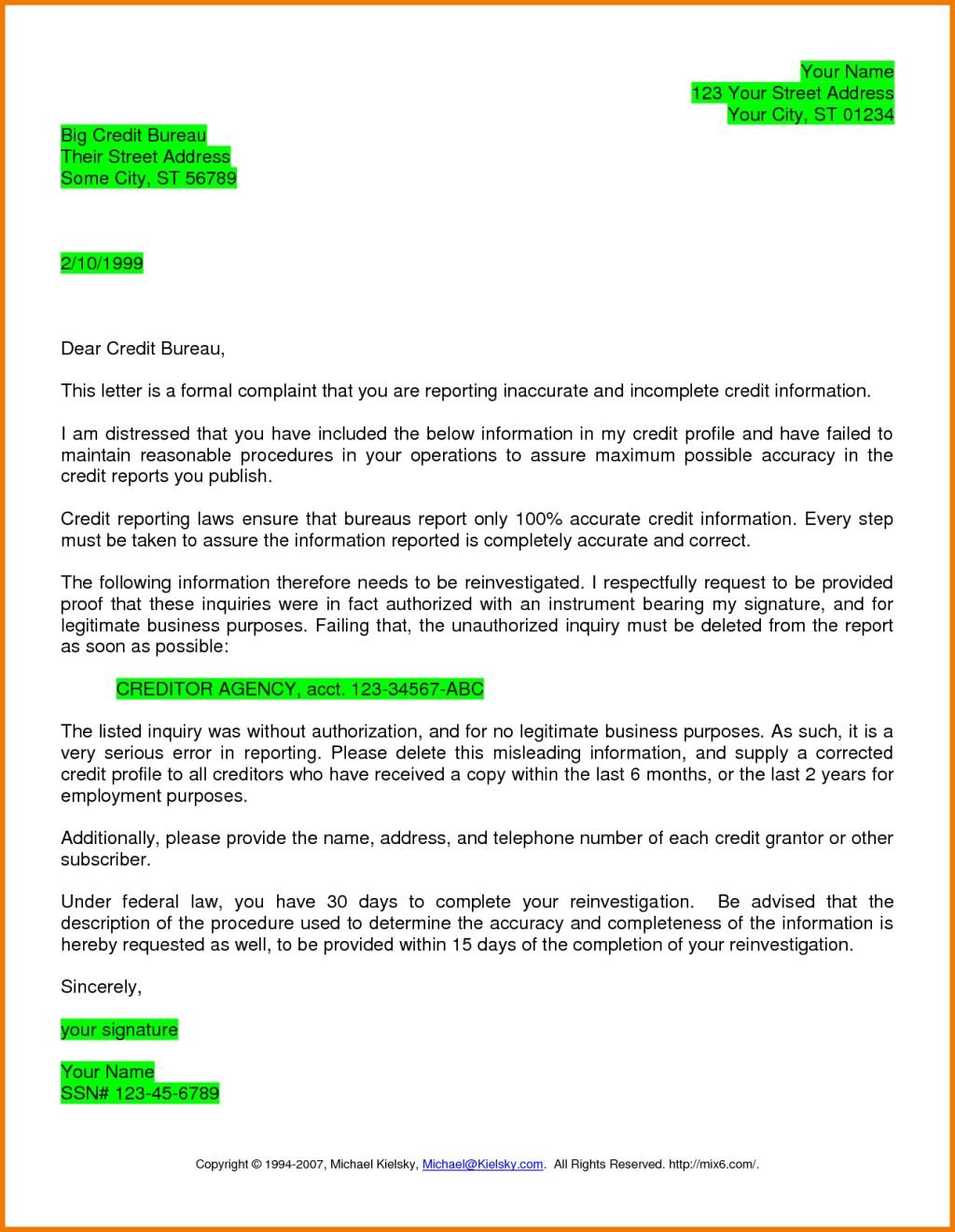

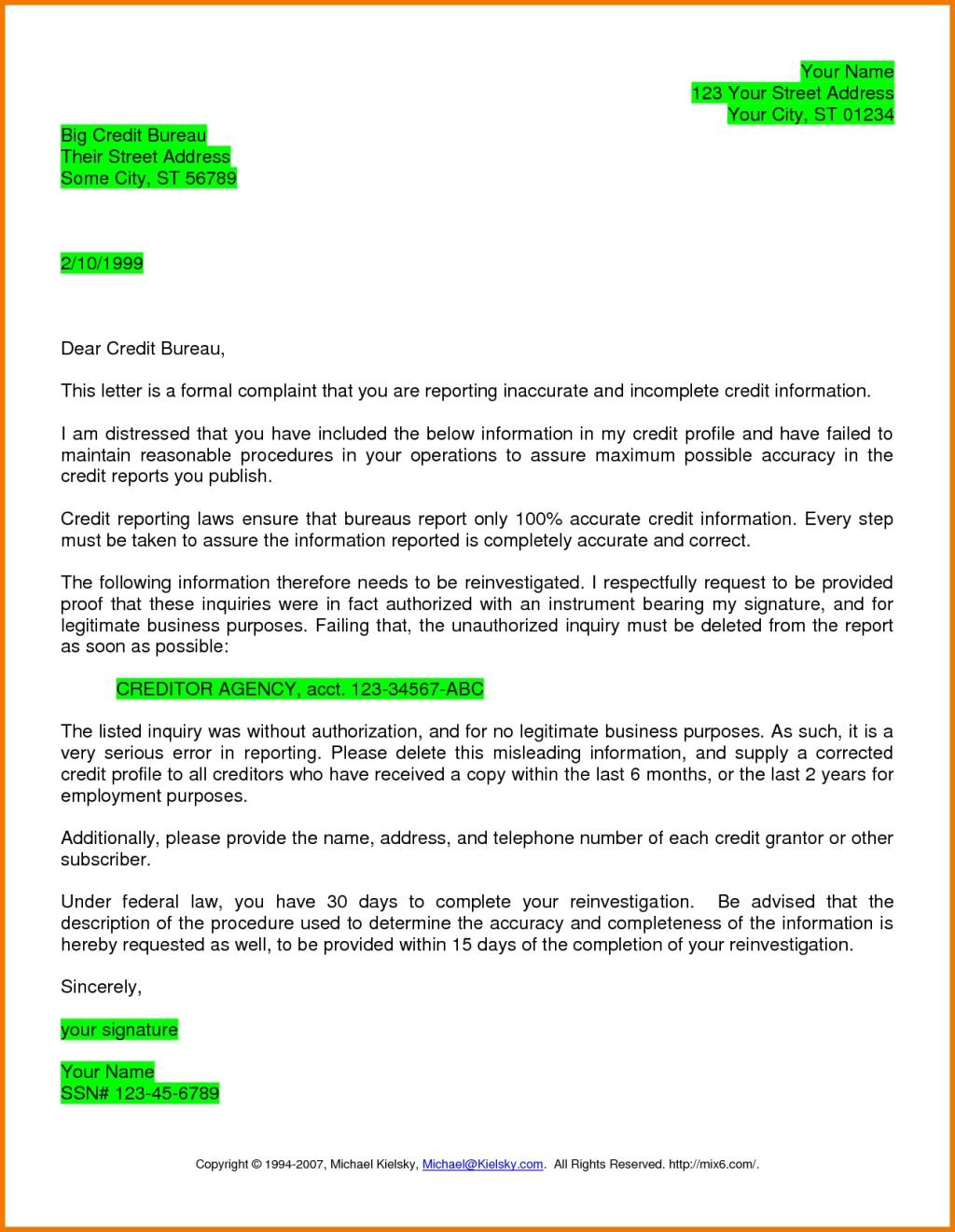

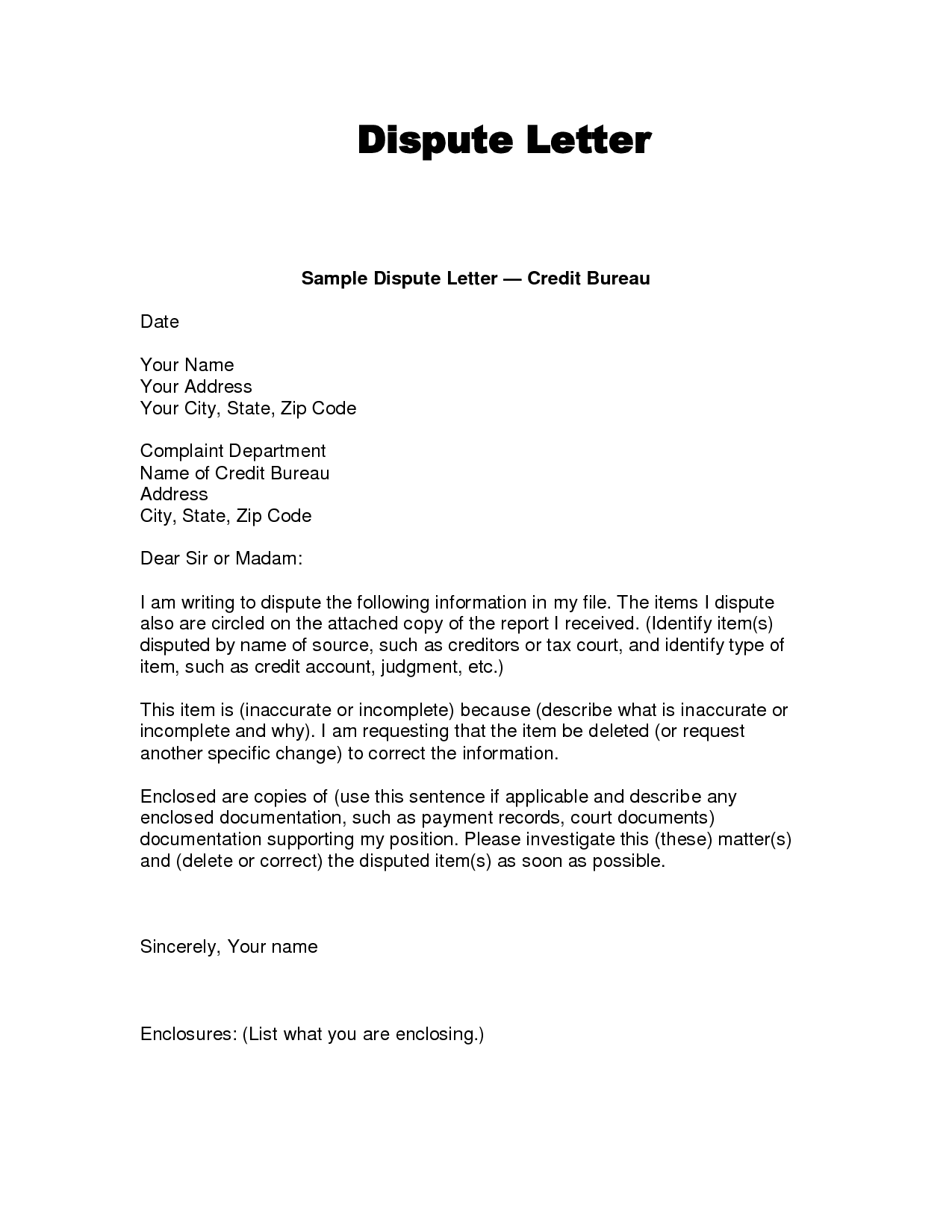

Start out here — Dispute Letter To Credit Bureau Template in your credit with this FREE OF CHARGE Initial Credit rating Dispute Notice Template An example credit report argument letter you need to use to question information from the credit report along with the credit bureaus. Apply our COST-FREE Credit Argue Letter Design templates to by law repair the own credit rating and increase your credit score! C onsumer Farrenheit inancial Public relations otection Bur ea u Learn more in consumerfinance. gov 1 of three SAMPLE CORRESPONDENCE Credit report challenge This guide gives information Credit rating Dispute Page – Asking Removal of Erroneous Information That is a free credit rating dispute notice.

Send this kind of letter for the credit bureaus asking the This kind of sample page will help you understand how to address the top credit bureaus regarding disputing problems on your Dispute Letter To Credit Bureau Template report. OBSERVE: Use this notification to argue a paid out collection or perhaps charge-off that is certainly showing seeing that unpaid.

The main element of bringing up-to-date this type of negative account to the letter can be sent to an gent who has accessed your own. Chances are great if you have been rejected credit that they may remove it mainly because they may Ways to Dispute The Transunion Credit history. TransUnion is certainly one of 3 major credit scoring bureaus in the usa – the other two being Equifax and Experian. To stop business collection agencies calls, you will need to send a cease and desist correspondence. Use this stop and abstain Dispute Letter To Credit Bureau Template to end debt collection phone calls.

Credit Bureau Dispute Letter

Sample Credit Bureau Dispute Letter

7 Steps (with Pictures)

Credit Report Dispute Letter Template Credit Repair SECRETS

Redit Dispute Letter Template

Section 609 Credit Dispute Letter Sample Credit Repair Secrets

Credit Dispute Letters

writing dispute letter format

Credit Dispute Letter Template